Dallas car title loans provide quick financial support with collateralized secured loans. To streamline approval, prepare documents like ID, insurance, and pay stubs in advance. Understanding flexible repayment options and choosing a reputable lender with transparent terms, competitive rates, and customer-centric approach ensures a swift and positive loan experience for Dallas car title loans.

“Dallas car title loans offer a fast and unique way to access cash using your vehicle’s equity. In as little as 30 minutes, you could be approved for a loan. This article guides you through the process, from understanding the basics of Dallas car title loans and their eligibility criteria to navigating the streamlined approval steps. We’ll also highlight the advantages of choosing a reputable lender, ensuring a secure and swift financial solution.”

- Understanding Dallas Car Title Loans: Eligibility and Requirements

- Streamlining the Approval Process: Steps to Get Approved Fast

- Benefits of Choosing a Reputable Lender for Your Loan

Understanding Dallas Car Title Loans: Eligibility and Requirements

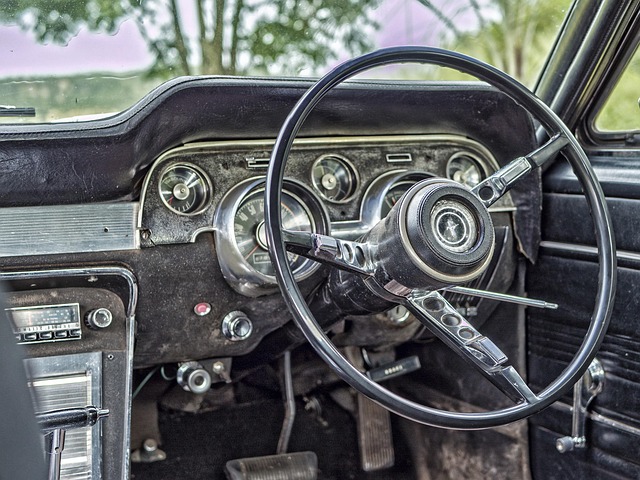

Dallas car title loans are a type of secured loan where borrowers use their vehicle’s title as collateral. This process allows for faster loan approval compared to traditional loans, making it an attractive option for those needing quick cash. The eligibility criteria and requirements vary among lenders but generally include having a clear vehicle title, a valid driver’s license, proof of income, and a working phone number.

The first step in the process involves providing personal information and details about your vehicle, including its make, model, year, and vehicle valuation. Lenders will then assess the value of your car to determine the maximum loan amount you may qualify for. Once your information is verified, the lender can provide a loan offer, and if accepted, you can complete the transaction, giving them temporary access to your vehicle’s title until the loan is repaid.

Streamlining the Approval Process: Steps to Get Approved Fast

Getting approved for Dallas car title loans can be a quick process when you know the steps to streamline your application. The key to getting fast approval lies in gathering all the necessary documents upfront, ensuring your vehicle is eligible as collateral, and providing accurate financial information. Start by collecting important papers like your driver’s license, proof of insurance, and recent pay stubs. This initial preparation significantly speeds up the verification process.

Additionally, understanding your repayment options can further expedite approval. Many lenders in Dallas offer flexible payment plans or loan extensions to accommodate borrowers’ needs. A cash advance might be an immediate solution if you’re in a pinch, but exploring these alternatives beforehand can help you make informed decisions and potentially fast-track your loan approval.

Benefits of Choosing a Reputable Lender for Your Loan

When considering a loan, especially Dallas car title loans, choosing a reputable lender is paramount. It’s not just about securing a financial solution; it’s also about ensuring your safety and peace of mind. A reliable lender will offer transparent terms and conditions, clear interest rates, and swift quick approval processes. They understand the urgency that comes with unexpected expenses and are dedicated to providing an efficient loan approval service.

By selecting a reputable institution, you gain access to professional advice tailored to your needs. This guidance is invaluable when navigating complex financial decisions. Moreover, a good lender prioritises customer satisfaction, ensuring your experience is positive and hassle-free, which is crucial in the context of loan approval.

Dallas car title loans offer a fast and convenient solution for those needing immediate financial support. By understanding the eligibility requirements and choosing a reputable lender, you can streamline the approval process and gain access to funds quickly. This method is particularly beneficial when time is of the essence, ensuring that you receive the assistance you need without unnecessary delays.