Applying for a Dallas car title loan involves meeting specific criteria: owning the vehicle outright and demonstrating its value through make, model, age, mileage, and condition. Lenders assess these factors to determine loan amounts, offering quick funding but carrying risks if the loan goes bad. The process begins with an online application, followed by physical inspection, and approval leads to direct disbursement. Key approvals factors include clear title documentation, vehicle condition, borrower creditworthiness, and stability in income and employment history.

In the competitive landscape of Dallas, understanding how lenders evaluate car title loan applications is crucial for prospective borrowers. This guide delves into the intricacies of securing a Dallas car title loan, providing a step-by-step breakdown of the application process and revealing key factors that influence approval. From meeting basic requirements to navigating potential challenges, this article equips folks with the knowledge needed to make informed decisions regarding their financial needs, focusing on the unique aspects of the Dallas market.

- Understanding Dallas Car Title Loan Requirements

- The Step-by-Step Application Process

- Factors Affecting Loan Approval in Dallas

Understanding Dallas Car Title Loan Requirements

When applying for a Dallas car title loan, understanding the requirements is key to a smooth process. Lenders in this city have specific criteria that borrowers must meet to be considered for funding. One of the primary factors is the condition and ownership of the vehicle. Borrowers typically need to own their cars outright, without any outstanding loans or leases, ensuring lenders can take possession if the loan goes into default.

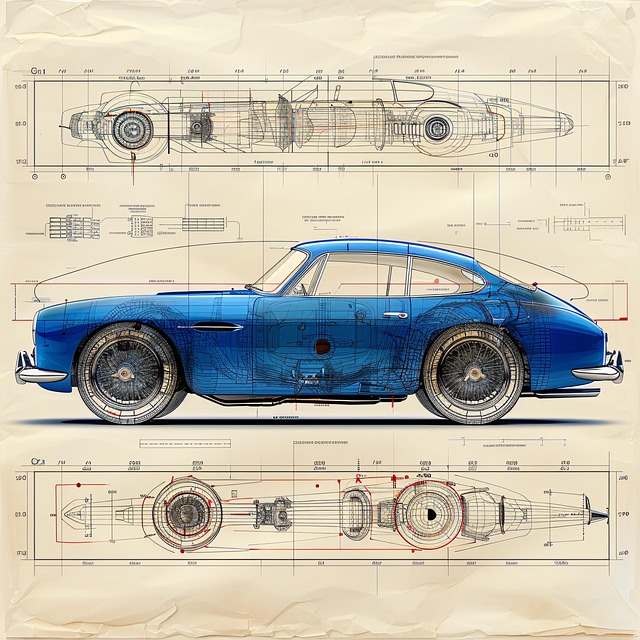

Additionally, Dallas lenders assess the vehicle’s value, often using a combination of its make, model, age, mileage, and overall condition. This appraisal guarantees that the loan amount offered is fair and aligns with the car’s potential as collateral. Emergency funds or unexpected expenses can be a financial solution for many, but it’s crucial to keep your vehicle as negotiations may not always allow for full recovery if the loan goes bad.

The Step-by-Step Application Process

Applying for a Dallas car title loan is a straightforward process designed to be efficient and accessible. The journey begins with an online application where prospective borrowers provide detailed information about their vehicles, including make, model, year, and current mileage. This initial step allows lenders to gauge the collateral’s value and determine initial eligibility for the loan. After submission, applicants await approval notifications from Dallas lenders who carefully review each application.

Upon approval, the next phase involves a physical inspection of the vehicle at a designated location. This inspection ensures that the car matches the details provided in the online application and verifies the borrower’s ownership. Once the vehicle is approved, the lender will disburse the loan funds directly to the borrower. The entire process is streamlined, making it convenient for those in need of quick funding, especially when compared to traditional loan options.

Factors Affecting Loan Approval in Dallas

Several factors influence whether a lender in Dallas approves a car title loan application. One of the primary considerations is the applicant’s vehicle ownership status; lenders require clear title ownership to secure the loan against the vehicle. The condition and age of the vehicle also play a significant role; lenders assess its market value and overall condition to determine if it adequately secures the loan amount.

Additionally, lenders evaluate the borrower’s creditworthiness, including their income, employment history, and existing debt obligations. These factors contribute to assessing the applicant’s ability to repay the loan. Lenders in Dallas often prefer borrowers with stable financial backgrounds as it mitigates the risk of default. The availability of vehicle collateral ensures that the lender has a form of security, enhancing the likelihood of approval for a car title loan.

Dallas car title loans can be a viable option for borrowers seeking quick cash. By understanding the local requirements, knowing the application process, and recognizing the factors that influence approval, you can make an informed decision. Lenders in Dallas carefully evaluate applications based on vehicle ownership, repayment capacity, and credit history, ensuring responsible lending practices. Remember, while these loans offer benefits, it’s crucial to borrow responsibly and have a plan for repayment to avoid potential financial challenges.